Hit the Road with Ease: Financing Your RV at a Credit Union

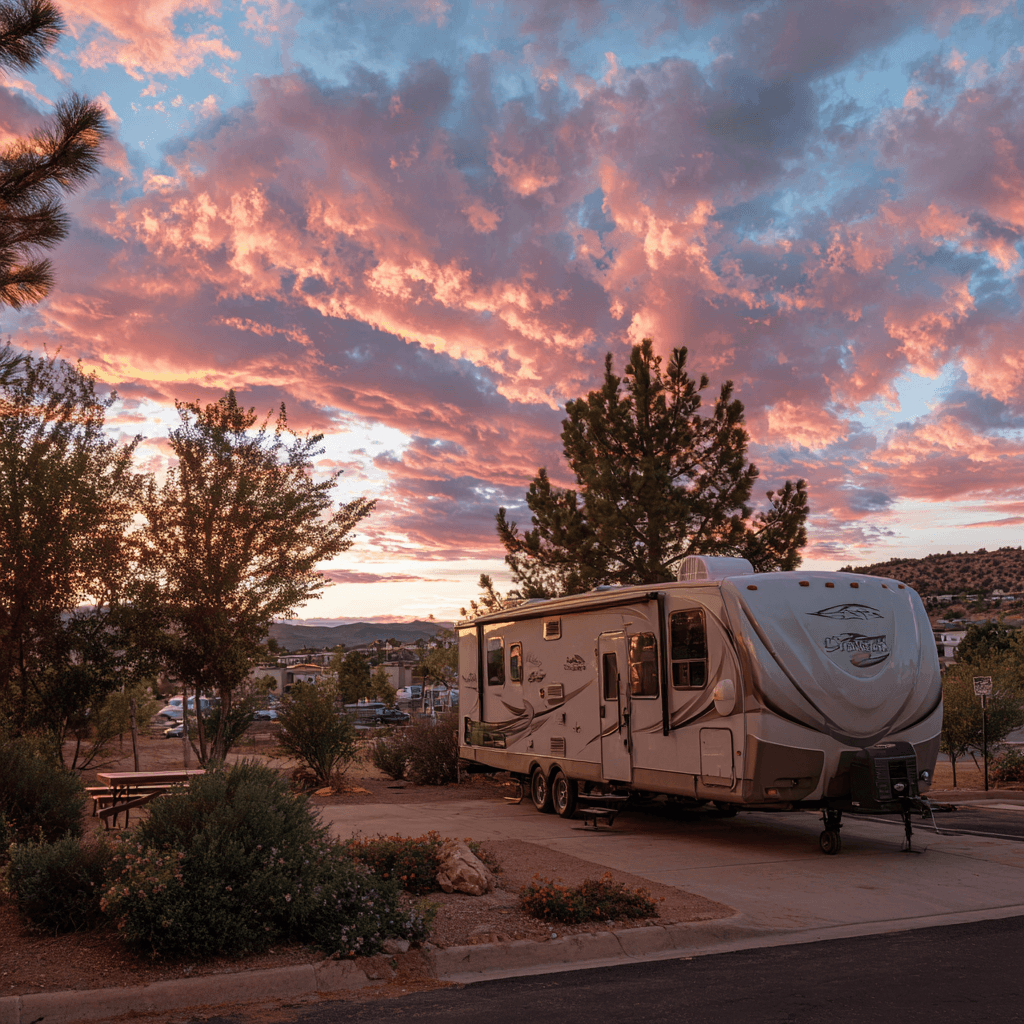

Dreaming of exploring picturesque landscapes in your very own RV? This article delves into how credit unions can offer a financially savvy solution to secure your dream RV. We'll guide you through financing at favorable rates, plus tips for hitting the road before year's end. Let the adventures begin!

Financing Your RV Dream through a Credit Union

Embracing the nomadic lifestyle and hitting the open road in an RV is a dream for many. However, financing such a venture can pose significant challenges. This is where credit unions come into play, offering distinct advantages to those looking to purchase an RV. With their member-focused ethos, you're likely to encounter more personalized service and competitive rates than those provided by traditional banking institutions.

Credit unions are not-for-profit organizations, which means they typically offer lower loan rates and better terms because any profit they make is returned to members in the form of reduced fees, higher savings rates, or lower loan rates. When it comes to financing an RV, these favorable conditions can have a significant impact on the overall cost of your loan.

To secure an RV loan through a credit union, the process typically starts with becoming a member. Eligibility can depend on various factors such as your geographic location, employer, membership in certain groups, or a family connection to an existing member. Once you've become a member, you can then explore the credit union's loan offerings. Here's a step-by-step guide on how to procure a loan:

-

Research and compare loan rates and terms.

-

Review your credit report to ensure you have the best chance of qualifying for a low-rate loan.

-

Apply for a pre-approved loan to know how much you can spend on an RV and to streamline the buying process.

-

If approved, finalize the loan terms and start shopping for your dream RV.

Securing an RV loan from a credit union can potentially lead to substantial savings. Here are some essential tips to make sure you get the best financing deal:

-

Shop around: Don't just accept the first offer; compare loan terms from multiple credit unions.

-

Consider a used RV: Sometimes a gently used RV can be a better value, and credit unions often offer loans for preowned vehicles.

-

Ask about additional costs: Be aware of any additional costs such as loan fees or penalties for early repayment.

-

Review your budget: Take a close look at your finances to ensure you can comfortably manage the loan repayments along with other RV-related expenses such as maintenance, fuel, insurance, and campground fees.

Planning for RV ownership goes beyond the initial purchase. As you consider your financing options, also think about the long-term costs associated with the RV lifestyle. This includes regular maintenance, fuel, park reservations, and any unforeseen repairs. Budgeting accordingly will ensure that your road-tripping adventures are not just a fleeting dream but a sustainable, long-term lifestyle. With smart financial planning and the right credit union partnership, you can hit the road with confidence, maybe even squeezing in a few memorable road trips before the year's end.

As you steer towards realizing your RV dream, align your expectations and financial capacity with the right loan product, and make sure you're adequately prepared for the journey ahead. A credit union can be the perfect financial co-pilot, offering both the personalized service necessary to navigate the initial purchase and the ongoing support to make your open-road adventures a resounding success.

Credit unions offer a unique financial opportunity for prospective RV owners, emphasizing a community-oriented, member-first approach. With typically lower interest rates and a personalized service, you can embark on your RV journey with peace of mind knowing you've secured a deal that suits your budget. Plan ahead, explore your options, and soon you'll be soaking in the delights of the open road.